There are plenty of uses for cryptocurrencies nowadays. They’re no longer only viewed as an investment vehicle by many who use them for payments and transactions of various kinds.

However, what many people who deal in cryptocurrencies may not know is that crypto credit cards offer even more convenience for daily transactions in the real world.

In other words, cryptocurrencies aren’t just for those familiar with digital payments made online but for every kind of consumer and retailer. How are crypto credit cards changing the way cryptocurrencies are viewed in the real economy?

What Are Crypto Credit Cards?

Crypto credit cards combine standard credit features with digital currency rewards or balances. Traditional lenders usually partner with crypto exchanges, allowing cardholders to spend funds as usual.

Rather than points or cash-back tied only to fiat, individuals might receive crypto tokens or hold balances in Bitcoin, Ethereum, or other coins. Some cards even permit direct conversion of crypto into local currency at the point of sale.

Many cards rely on established payment networks. Merchants process transactions just like standard credit card purchases, with the crypto element handled in the background. This design removes complexities often linked to digital currency wallets. A user might still check a card statement, but there is an additional ledger reflecting earned or spent crypto.

How Crypto Credit Cards Operate

A standard credit card examines credit history and sets a limit. With a crypto-linked card, there is an extra arrangement with a crypto platform. When a purchase occurs:

- Transaction Approval: The issuing bank authorizes payment, similar to any credit card.

- Crypto Conversion: Some cards automatically sell the required amount of crypto in real time to settle the charge.

- Rewards Allocation: Instead of airline miles or fiat cash-back, rewards appear as crypto deposits.

Several providers use different fee structures. Annual fees, foreign transaction fees, and interest rates can vary widely. In certain cases, a linked crypto balance might serve as collateral. Companies might lock a specific amount of digital coins to assure repayment.

Benefits of Crypto Credit Cards

1. Buy Goods With Pre-Pair Crypto Credit Cards

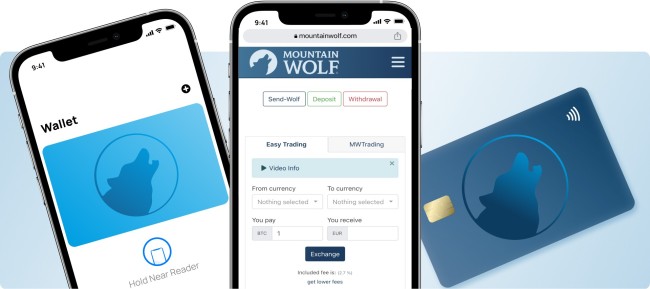

To begin with, crypto cards can be used just like regular credit or debit cards. The only difference is that you need to load them with credit. That’s easy to do and it works in much the same way – and with the much same security standards – as a digital wallet.

With their pre-paid crypto prepaid card offerings, the likes of Mountain Wolf have made it much easier to buy goods with a range of cryptocurrencies. Load your Bitcoin or Solana balance – or whichever cryptocurrency you wish to use – onto the card and then spend it as you normally would with any conventional card payment.

Retailers get their payment in the currency they trade in and your balance on the card is adjusted accordingly. What could be simpler even if you want to buy goods from a seller who’s never even heard of crypto payments before?

2. Procure Services With Cryptocurrency Pre-Payment Cards

It is worth noting that you don’t only have to be talking about buying goods from e-commerce sites and shops when it comes to pre-paid crypto cards. Many professional service providers will also accept these types of payments.

If you want to use crypto on a daily basis for payments, then why not switch your gym membership subscription or your streaming service transactions to your crypto card. All you need to do is enter the card’s details into their payment portal and regular transactions are set up, ready to go.

3. Pay Overseas Sellers Without Currency Exchange Fees

A key plus point of pre-paid crypto cards over their conventional counterparts is that you can make payments in any fiat currency. Typically, the value of such cards lies in the fact that they retain credit in the cryptocurrency they’re loaded with. This only converts to a fiat currency when you make a payment.

Compare that to the fees some credit cards charge for making payments in dollars, pounds and euros on the same card. Depending on which sort of credit card you use, such fees can be augmented by unfavourable foreign currency exchange rates. Cryptocurrencies, though, are borderless by design and much better suited to international transactions.

Risks and Drawbacks

Crypto credit cards carry unique challenges alongside traditional credit card issues:

- Price Volatility: Digital currencies can swing quickly. A large reward might shrink in value if prices drop.

- Regulatory Uncertainty: Government policies around digital assets change frequently. Unexpected regulations can hamper usage or force card providers to modify terms.

- Fees: Crypto trading fees for conversions can be higher than typical currency exchanges. Some users may face surcharges for converting tokens, leading to hidden costs.

- Security Concerns: Crypto-related scams can be sophisticated. Account security must remain a priority, or funds and rewards might vanish.

Careful reading of terms is essential. Some providers are small startups with short track records. Others function under large financial networks, which might provide more consistent backing.

Rewards and Perks

Several crypto credit cards emphasize unusual perks. A traditional card may offer 1%-2% cash-back, but some crypto versions promise higher percentages in tokens. Examples include:

- Generous Crypto Rewards: Some platforms market 3%-5% rebates paid in popular tokens.

- Staking Bonuses: Certain card issuers encourage staking. Locking tokens for a set duration might unlock higher-tier rewards or reduce fees.

- Partner Discounts: A few cards feature merchant partnerships, granting discounts or exclusive offers when using the card for specific brands.

Rewards fluctuate with crypto prices, which can be a benefit or a risk. Receiving rewards during a bull market might boost the user’s overall balance, while a downturn can reduce it.

Impact on Traditional Finance

Banks and credit unions once viewed digital currency as a speculative product. Evolving consumer habits and the rise of blockchain-based finance are encouraging cautious collaboration. Mainstream players see crypto credit cards as a source of new business. Joint ventures aim to entice a younger demographic and technology enthusiasts.

Traditional finance gains insight into cryptographic payment flows, while digital currency firms tap into large-scale distribution channels. This collaboration changes how merchants perceive crypto-based transactions.

Some businesses are curious about incorporating direct crypto payments, fueled by the possibility of drawing new clientele. Meanwhile, ongoing debates center on whether crypto usage will ever match the stability of well-established payment systems.

Growing Presence Worldwide

Crypto credit cards are no longer limited to a few tech-savvy regions. Companies launch pilots worldwide, showcasing local adoption in areas where digital currencies appeal to underbanked populations.

Many cardholders in emerging markets appreciate the chance to earn or spend tokens that might hold more long-term promise than local tender.

This presence raises questions about whether large-scale acceptance of crypto as payment is near. Skeptics highlight ongoing volatility, while supporters suggest incremental shifts. Some see crypto credit cards as a natural progression, building on earlier efforts to link digital tokens to everyday transactions.

Security and Fraud Prevention

Security remains a top priority for those adopting crypto. Crypto credit cards combine elements of traditional banking with the complexities of blockchain assets. Breaches can involve fraudulent charges or stolen tokens. Providers address these threats with:

- Encryption and Multi-Factor Authentication: Standard best practices help secure login information.

- Cold Storage for Rewards: Some issuers store reward balances offline to safeguard against hacking.

- Transaction Monitoring: Suspicious patterns often trigger freezes or alerts, similar to conventional credit cards.

A layered approach can protect users. Cardholders must also stay vigilant, keeping track of recent updates from their card provider. Routine checks of transaction histories can spot potential anomalies before damage spreads.

Regulatory Factors

Authorities in different regions approach crypto in unique ways. Some countries adopt friendly policies, while others enforce strict limitations. Crypto credit cards exist in a shifting environment, where providers must adapt to local rules. Regulation might influence:

- Tax Reporting: Earning crypto can trigger tax obligations, often requiring detailed record-keeping.

- Compliance Requirements: Stringent protocols on anti-money-laundering (AML) or know-your-customer (KYC) rules can affect how cards are issued.

- Consumer Protections: Laws designed for fiat credit cards sometimes extend to crypto products, though coverage can vary.

Unstable policy frameworks create challenges for both companies and consumers. Some providers withdraw from certain countries to avoid regulatory conflict.

Future Outlook of Crypto Credit Cards

Growing familiarity with digital currencies suggests that crypto credit cards might play a role in bridging traditional finance and blockchain-based systems.

Crypto-savvy users appreciate convenience and see these cards as a step forward. Mainstream users might take a cautious approach, waiting for stable regulations and widespread acceptance.

Expanding merchant networks could further boost demand, especially if card providers negotiate attractive deals or loyalty programs.

Continued technological improvements may lower fees and speed up transactions. Ongoing partnerships between banks and crypto firms might yield new products, such as hybrid accounts blending fiat and digital currencies without complex conversions.

A few industry watchers predict that crypto credit cards will spur new habits in spending and saving. The cards offer a chance for digital currency to become more than a speculative asset.

Steadier prices and transparent rules would likely encourage more merchants to embrace tokens as part of everyday commerce. Skeptics maintain that severe volatility and lack of clear guidelines will hinder adoption. The immediate future likely depends on how providers navigate these obstacles.

Practical Tips for Those Considering a Crypto Credit Card

Prospective cardholders can reduce risks by following basic guidelines:

- Research Reputable Issuers: Platforms backed by recognized financial partners tend to deliver better support.

- Compare Fees: Some crypto credit cards charge high annual costs or hidden exchange fees. Reading fee schedules helps avoid surprises.

- Understand the Rewards: A high percentage in token form can be tempting, but reward value might shift with market movements.

- Stay Updated on Regulations: Sudden changes in tax rules or local policies may impact usage. Following official announcements avoids unpleasant surprises.

- Keep Security in Mind: Activating two-factor authentication and monitoring account activity can thwart fraud attempts.

A balanced approach often yields better outcomes. Crypto credit cards can serve as a novel way to earn or spend digital currency, but caution is recommended.

Conclusion

Crypto credit cards offer possibilities that span both convenience and speculation. They merge traditional banking features with digital currency rewards, enabling everyday transactions with a dash of modern flair.

Potential rewards can be appealing, but price swings and regulations demand close attention. Evolving partnerships between banks and crypto firms shape future growth, hinting at expanded adoption.

Users keep security, fees, and transparency in mind, knowing the marketplace can shift quickly. These factors combine to determine whether crypto credit cards can hold a steady place in the broader economic system.